IRR

Basic Overview

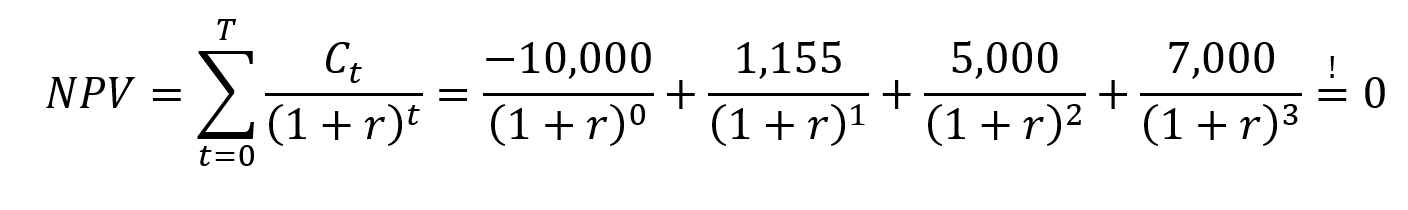

Description | Internal rate of return (IRR) is a metric of profitability for potential investments. Internal rate of return is a discount rate that sets the net present value (NPV) of all future cash flows the investment equal to zero. An approximate solution is found using numerical iteration. |

|---|---|

Signature | IRR(Node [, Guess]) |

Parameters |

|

Example

We have project with following cash-flows.

'CF'=

Year | CF |

|---|---|

2018 | -10000 |

2019 | 1155 |

2020 | 5000 |

2021 | 7000 |

Our goal is to find a discount rate with which the discounted cash flows sum-up to zero:

IRR('CF')=

Year | Totals |

|---|---|

2020 | -23% |

2021 | 12% |

The IRR function tells us the rate is 12%. The result for Cash Flows up to year 2020 is not interesting for us and can be filtered out with FILTER function.